The ever-evolving landscape of advanced materials and manufacturing, Low-Temperature Co-Fired Ceramic (LTCC) and High-Temperature Co-Fired Ceramic (HTCC) technologies have emerged as pivotal components, revolutionizing the production of electronic components and advanced ceramics. The global LTCC and HTCC market share, with a combined value of USD 1,077.38 million in 2023, signify the growing influence of these technologies. Prognosticated to surge at a commendable Compound Annual Growth Rate (CAGR) of 4.5% from 2024 to 2032, the markets are poised to reach an estimated value of USD 1,605.30 million by 2032. In this exploration, we delve into the key benefits, industry developments, driving factors, the impact of the COVID-19 pandemic, restraining elements, market segmentation, trends, regional insights, and top impacting factors within the realms of LTCC and HTCC technologies.

Market Overview:

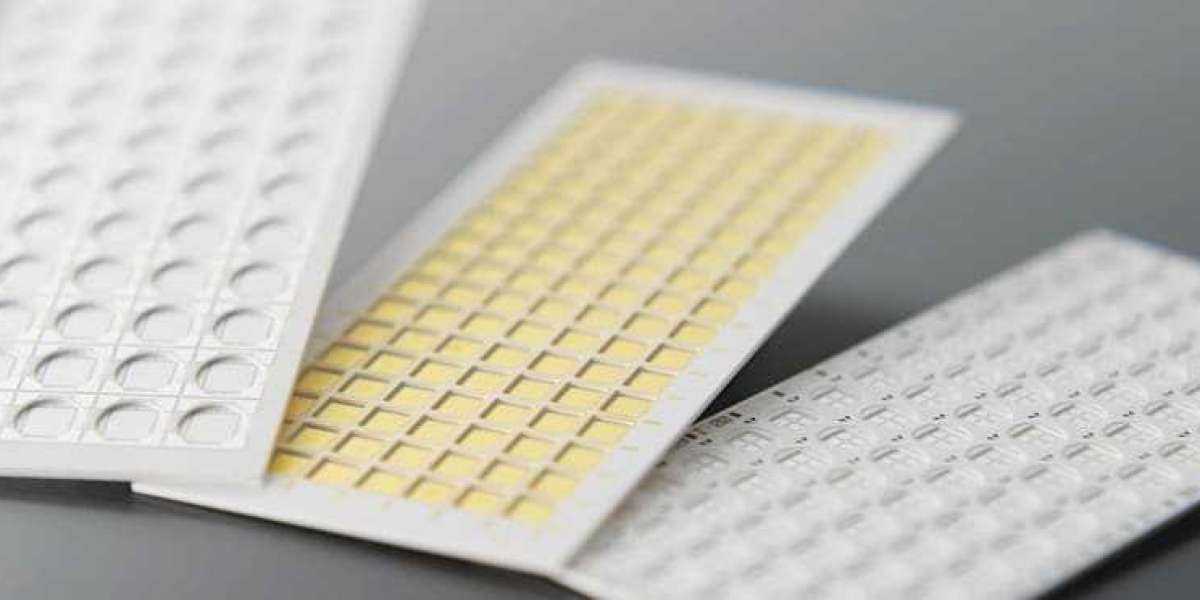

LTCC and HTCC technologies play a pivotal role in the manufacturing of electronic components, sensors, and advanced ceramics. These co-fired ceramic technologies involve the sintering of multiple layers of ceramics, creating integrated, high-performance components with applications ranging from telecommunications and automotive to aerospace and healthcare.

Key Benefits:

- Multilayer Integration: LTCC and HTCC technologies enable the integration of multiple layers of ceramics, facilitating the creation of complex, multilayered electronic components with enhanced functionality.

- High Thermal Conductivity: These technologies provide high thermal conductivity, making them suitable for applications in industries such as electronics, where heat dissipation is critical for optimal performance.

- Miniaturization and High Precision: LTCC and HTCC technologies allow for the miniaturization of electronic components, enabling the production of high-precision devices with reduced form factors.

Key Industry Developments:

- Integration in 5G Technology: The rollout of 5G technology has driven the demand for LTCC and HTCC components in the manufacturing of antennas, filters, and other critical elements for high-frequency communication.

- Expansion in Automotive Electronics: The automotive industry's increasing reliance on electronic components for safety, connectivity, and automation has led to a growing demand for LTCC and HTCC technologies in the production of sensors and control units.

- Medical Device Applications: LTCC and HTCC technologies find applications in the medical device industry, particularly in the development of high-frequency sensors and implantable devices.

Driving Factors:

- Rapid Technological Advancements: Ongoing technological advancements in electronics, telecommunications, and healthcare drive the need for innovative and high-performance components, fueling the demand for LTCC and HTCC technologies.

- Increasing Adoption in Aerospace: The aerospace industry's focus on lightweight materials and advanced electronics has led to the adoption of LTCC and HTCC technologies in the production of sensors, communication devices, and satellite components.

- Demand for Miniaturization: The trend towards miniaturization of electronic components in various industries, including consumer electronics and medical devices, propels the demand for LTCC and HTCC technologies.

COVID-19 Impact:

The COVID-19 pandemic has influenced the LTCC and HTCC markets, reflecting the broader challenges faced by industries worldwide.

- Supply Chain Disruptions: The pandemic led to disruptions in the global supply chain, affecting the availability of raw materials and components, impacting production schedules for LTCC and HTCC technologies.

- Slowdown in End-Use Industries: Industries such as automotive and aerospace experienced slowdowns, affecting the demand for electronic components and, subsequently, LTCC and HTCC technologies.

- Shift in Consumer Behavior: Changes in consumer behavior and priorities during the pandemic influenced the demand for electronic devices, impacting the market for LTCC and HTCC applications.

Restraint Factors:

- High Production Costs: The production of LTCC and HTCC components involves sophisticated manufacturing processes, leading to relatively high production costs compared to conventional technologies.

- Limited Awareness: The limited awareness of LTCC and HTCC technologies among end-users and manufacturers poses a challenge to widespread adoption, particularly in industries less familiar with these advanced ceramic technologies.

Market Segmentation:

The LTCC and HTCC markets are segmented based on application, end-use industry, and region.

- By Application:

- Filters

- Antennas

- Sensors

- Capacitors

- Others

- By End-Use Industry:

- Electronics and Telecommunications

- Automotive

- Aerospace and Defense

- Medical Devices

- Others

- By Region:

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Market Outlook and Trends:

The outlook for the LTCC and HTCC markets is characterized by trends and evolving industry dynamics.

- Growing Emphasis on Sustainability: The adoption of LTCC and HTCC technologies aligns with the broader trend towards sustainability, given their potential for reducing the environmental impact of electronic component manufacturing.

- Advancements in 3D Printing: The integration of 3D printing technologies with LTCC and HTCC processes is opening new possibilities for creating intricate and customized ceramic components.

- Focus on Healthcare Applications: The healthcare industry's increasing reliance on electronic devices and sensors drives the demand for LTCC and HTCC technologies in the development of medical implants and diagnostic devices.

Industry Segmentation – Manufacturing, Advanced Materials:

Within the vast scope of manufacturing and advanced materials, LTCC and HTCC technologies hold a significant position, influencing the production of advanced ceramics and electronic components.

- Advanced Ceramics Production: LTCC and HTCC technologies play a crucial role in the production of advanced ceramics, supporting applications in diverse industries, from electronics to healthcare.

- Electronic Component Manufacturing: The integration of LTCC and HTCC technologies in electronic component manufacturing contributes to the production of high-performance components with applications in various industries.

Major Key Players:

- Kyocera Corporation: A leading player in the advanced ceramics industry, Kyocera Corporation is actively involved in the development and production of LTCC and HTCC technologies for a wide range of applications.

- Murata Manufacturing Co., Ltd.: Murata is a major player in the electronics industry, specializing in the development of electronic components, including LTCC-based filters and antennas.

- CeramTec GmbH: CeramTec is a global provider of advanced ceramic solutions, contributing to various industries, including automotive, electronics, and medical, with its expertise in ceramic technologies.

Opportunities:

- Expansion in Electric Vehicle (EV) Market: The rising adoption of electric vehicles presents opportunities for LTCC and HTCC technologies in the production of electronic components for EVs.

- Increased Connectivity Needs: The growing demand for connectivity in smart devices, IoT applications, and 5G technology creates opportunities for LTCC and HTCC technologies in the development of high-frequency components.

Challenges:

- Limited Adoption in Some Industries: Industries less familiar with advanced ceramics may show resistance to adopting LTCC and HTCC technologies due to a lack of understanding or awareness.

- Global Economic Uncertainties: Economic uncertainties and fluctuations in global markets can impact the demand for electronic components and, consequently, the market for LTCC and HTCC technologies.

Scope:

The scope of LTCC and HTCC technologies extends beyond traditional ceramics, influencing the production of electronic components and advanced materials. As industries increasingly prioritize efficiency, miniaturization, and sustainability, the scope for these advanced ceramic technologies continues to expand.

The global LTCC and HTCC markets, with their innovative applications and contributions to advanced materials and manufacturing, stand at the forefront of technological evolution. As industries seek to address challenges related to miniaturization, thermal conductivity, and sustainability, the demand for LTCC and HTCC technologies is expected to persist and grow. Opportunities in electric vehicles, healthcare applications, and the ongoing advancements in 3D printing present exciting prospects for the future. Challenges, including high production costs and limited awareness, are met with continuous efforts to educate and innovate. In this dynamic landscape, LTCC and HTCC technologies remain key players in shaping the future of electronic components and advanced ceramics, providing a foundation for technological progress across diverse industries.